How can I make use of an ISA to maximise my savings?

Any time is the perfect time to start thinking about the best way to be smart with your finances.

One of the most popular financial goals is, of course, to start saving a little more. A great way to do this can be through an Individual Savings Account – more commonly known as an ISA. ISAs offer a tax efficient way of investing your money and, from the start of a new tax year in April, the tax-free allowance of £20,000 renews. This means that until next April when the allowance renews again, everyone has the opportunity to invest up to this amount into an ISA without needing to pay any tax on interest or dividends earned.

So, how can we make use of an ISA to maximise our savings?

There are several different types of ISA which all offer different benefits and restrictions – the best one for you is likely going to depend on the reason why you are saving. For example, a Lifetime ISA might be the best choice if your goal is to save for to buy a house as the government offer a cash bonus on your savings for this purpose. However, if you don’t have anything specific in mind but still want to start making saving a little money a regular habit, a Cash ISA is likely to be your best bet.

Let’s have a look at how you could harness the power of compound interest with an ISA to turn a little cash into a sizeable savings pot, the best Cash ISAs on the market for 2024, and four questions you should ask yourself when choosing an ISA provider.

Only got a small amount to save? It’s still worth getting started

Just because you don’t have hundreds or thousands of pounds to put aside, it’s still absolutely worth getting started with saving!

Unlike putting your savings aside in cash, when you put your money into an ISA you will earn interest from it. If you leave this extra interest you’ve been paid in your account then the next time your interest is calculated, it too will contribute to how much you earn. This is called compound interest. Over time, compound interest means that even small amounts of cash can steadily grow into an impressive pot.

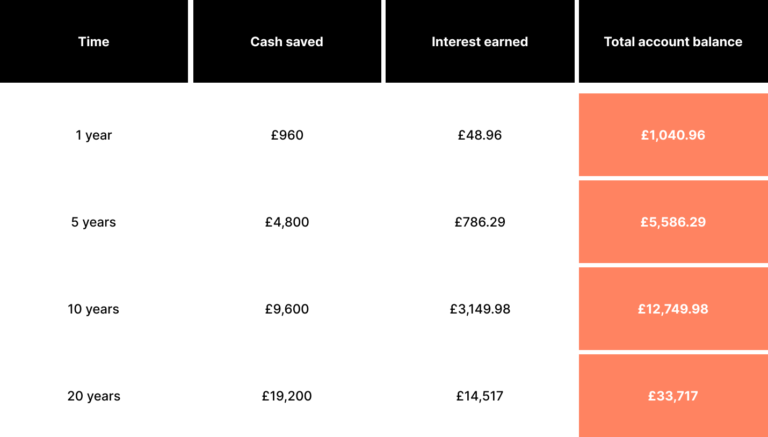

Let’s have a quick look at an example of how putting away just £20 per week – which is probably less than the cost of a Friday night takeaway – can grow over the years*:

* For illustrative purposes only, calculated saving £80 per month at 5.10% AER applied for the whole duration assuming no withdrawals are made.

”"THE KEY TO MAKING THE MOST OF AN ISA IS TO LEAVE YOUR MONEY IN IT AS LONG AS POSSIBLE. A TIP IS TO OPEN YOUR ISA IN A DIFFERENT PLACE TO YOUR MAIN BANK ACCOUNT. THIS WAY YOUR SAVINGS ARE OUT OF SIGHT AND THERE’S LESS TEMPTATION TO DIP IN. "

EmanFounder OnestopSave

WHERE TO FIND THE BEST CASH ISA RATES IN 2024

Remember that these rates were correct when we checked them but could now be different – rates can also change during the time you hold your ISA, so be sure to check out the terms and conditions to see whether there are any rate guarantees for an extra bonus!

Never heard of Plum, Moneybox, Chip or Zopa before? Don’t worry. All the above providers are protected by the Financial Services Compensation Scheme (FSCS). This means up to £85,000 of your money can be recovered in the unlikely event that the provider has to shut its doors.

When it comes to savings you usually won’t find the best rates at high street banks. But if you prefer to keep your money in one place or with a provider you recognise, then that’s fine too. It is worth keeping in mind that many of the above providers offer double (if not more!) the rates of high street banks – which mean your savings may grow a little quicker.

Consider these things when choosing your ISA provider

Other than the interest rate on offer, there are a few other things you may want to consider when choosing the best ISA provider for you:

- How much are you going to initially deposit? Some ISA providers ask for at least £100 or even £500 to be deposited when you open the account. Others, such as Zopa, are happy for you to get started with as little as £1.

- How do you like to manage your money? Some high streets banks and building societies require you to visit a branch or log into online banking to manage your ISA, which can be a little time consuming. Other providers offer apps which can be handy for making quick deposits or even automating your payments for payday.

- What are your saving aims? If you have a specific goal in mind, such as saving for a house or your child’s future, then you might be able to access some more favourable benefits by opening an ISA specifically created with these purposes in mind. Make sure to do some extra research on the best option for you!

- Are you likely to make regular withdrawals? Some providers will reduce your rate if you take money out of your ISA too frequently – even with an easy-access Cash ISA. Providers like Zopa and Chip don’t have withdrawal restrictions, so it might be worth checking them out if you aren’t sure when you’ll need to access your cash.

This information is intended for editorial purposes only and not intended as a recommendation or financial advice