Credit cards can be a handy and flexible way to borrow money to see you through to the next payday or beyond. They enable you to borrow money up to a set credit limit which you then repay in flexible monthly instalments. If you don’t pay off the balance in full each month, interest is often charged.

But with so many different providers and cards to choose from, deciding which credit card to pick can be a bit of a minefield. This guide aims to help you choose the right credit card for you.

Getting started

If you’re pretty new to credit and have yet to build up much of a credit history, it’s unlikely you’ll be accepted for the most competitive credit cards on the market. But there are still plenty of options to choose from.

A good place to start is with a credit builder credit card.

How do credit builder credit cards work?

Credit builder credit cards are designed for those with no credit history or a low credit score. They offer a lower credit limit to start with, but this could increase over time if you maintain a good payment history. Interest rates are typically higher compared to standard credit cards, so it’s important to clear your balance each month.

If you use your card sensibly, your credit score should start to improve after a number of months and this can help you access more competitive credit cards later on.

Good examples include the Sainsbury’s Everyday credit card and the Tesco Foundation credit card. The Sainsbury’s card offers a credit limit of between £1,000 and £2,000 depending on your circumstances, and a guaranteed interest rate of 29.4% APR. You can also earn Nectar points as you spend.

The Tesco Foundation card offers a starting credit limit of between £250 and £1,000 and a representative APR of 29.9% (your rate could be higher than this, depending on your circumstances). You can also collect Tesco Clubcard points when you spend. Just resist the urge to spend more than you can afford to repay in a bid to earn more points.

”A CREDIT CARD MAY BE ONE WAY TO BUILD YOUR CREDIT SCORE

EMANFinancial Adviser, OnestopSave

What are my other options?

If you’ve already started to build up a credit history, you might be able to apply for a more competitive credit card. But you’ll need to consider what you primarily want to use the card for, before you can settle on the best credit card for you.

Spreading the cost of purchases

If you’re looking to spread the cost of a large purchase, such as new furniture or a new boiler, or make a number of smaller purchases, a 0% purchase credit card can help you. These cards enable you to spread the cost of your purchases over a number of months without paying interest.

The amount you can spend will depend on your credit limit but it’s important to pay off your balance in full before the 0% period ends and interest kicks in. Barclaycard currently offers the top deal, offering up to 21 months at 0% on purchases. You’ll need to have a good credit score to get the 21 months, but if not, you could still be offered 10 months’ interest-free.

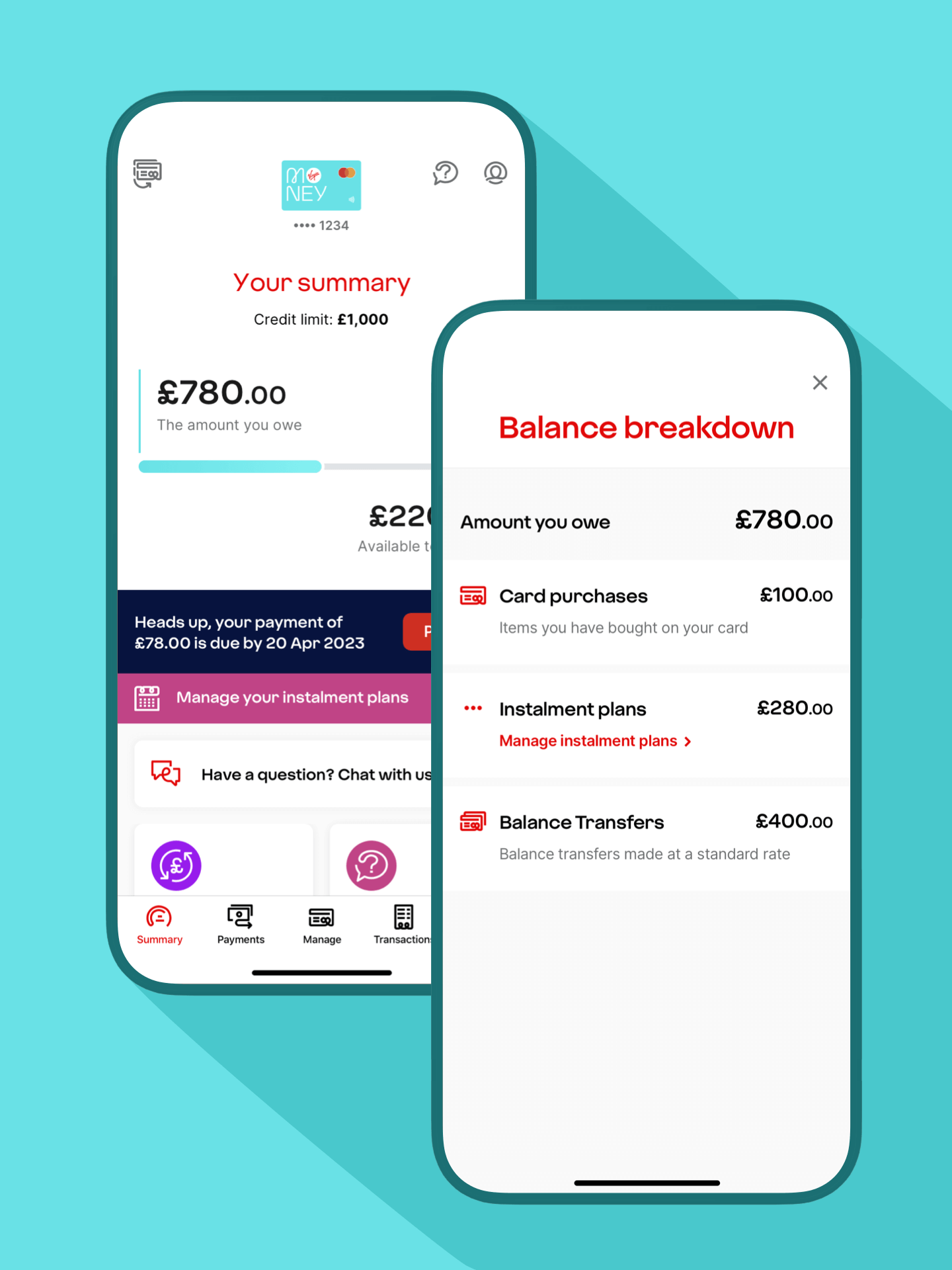

Alternatively, the Virgin Money All Round credit card offers 12 months at 0% and doesn’t require a perfect credit history.

If you’d prefer to use your credit card for ongoing, smaller purchases, a low APR credit card could be more suitable. This card type offers a low rate of interest for the life of the debt, rather than an interest-free period that expires after a set time. A good example is Tesco Bank’s Low APR credit card with an APR of 10%.

Paying off existing card debt more cheaply

If you already have credit card debt to pay off that’s racking up a high rate of interest, shifting your debt to a 0% balance transfer credit card can give you a bit of breathing space. These cards won’t charge interest on balances transferred over from other cards for a number of months.

The top deal right now is from Barclaycard (again) and offers up to 29 months at 0% on balance transfers. Just be aware that you will need to pay a 3.45% fee on the amount you transfer to the card. If you transferred £2,000, you’d have £69 added to your balance.

Virgin Money’s All Round credit card also offers 12 months at 0% on balance transfers and could be more suited to those with poorer credit scores. It has a lower transfer fee of 3%.

Some balance transfer credit cards won’t charge a transfer fee at all. But they’ll usually offer a shorter 0% balance transfer period in return. These are worth considering if you’re confident you can clear your balance within the shorter timeframe.

Saving on spending abroad

Some credit cards are designed to help you save money when you travel abroad. These cards won’t charge you a fee for using your card for purchases or cash withdrawals overseas.

However, these cards won’t typically offer interest-free spending and if you use your card for cash withdrawals, interest will usually apply from the moment you get your cash, making it very expensive. An exception is the Barclaycard Rewards Visa which won’t charge a fee for foreign transactions and also won’t charge interest on cash withdrawals if you repay your balance in full each month.

Earning rewards

If you religiously pay off your credit card balance in full each month, it’s worth looking for a credit card that offers perks such as cashback on your spending, airmiles or loyalty points. That way you’ll earn something back for your spending.

Just watch out for cards that charge annual fees and avoid overspending in an effort to earn more rewards. Many of these cards charge high interest rates, so it could end up costing you a lot more in interest than you earn in rewards if you don’t use the card carefully.

One example is the American Express Platinum Cashback Everyday credit card which pays 5% cashback on card purchases up to £100 for the first three months, and up to 1% cashback after that, depending on how much you spend. There’s no annual fee but the APR is high at 31.0%.

Do I need a high income to get accepted for a credit card?

Not necessarily. In fact, high income requirements are usually for credit cards that offer more exclusive rewards and benefits that you might not want or need. Standard credit cards might not have a set income requirement or if they do, the requirements could be much lower.

To apply for your first credit card with Barclaycard, for instance, you only need to earn over £3,000 a year, while Nationwide asks for a minimum annual income of £5,000. HSBC’s Classic credit card (another credit building card) requires an annual income of £6,800 or more and Santander asks for an income of £10,500 or more a year.

Many credit card providers will look at other factors, not just your income, before deciding whether you let you borrow. This can include how much outstanding debt you already have and your existing financial commitments. Some providers will also include certain benefits or child maintenance as income, rather than focus solely on your salary.

Before applying for any type of credit card, it’s sensible to use an eligibility checker. Most providers offer these on their websites and they let you see how likely you are to be accepted for a particular credit card without affecting your credit score. If your chances are good, you can go ahead and apply in full.

This information is intended for editorial purposes only and not intended as a recommendation or financial advice