Make your daily shop pay back in 5 minutes

It often feels like ‘‘just popping to the shop” comes around way too often: pint of milk, bag of loo rolls, meal deal for lunch – the list feels endless. We’ve all had enough of hearing politicians bang on about the cost of living crisis now it’s become our everyday reality, so we got to thinking about how we could save more and get a bit back on those essentials.

If you’re like us and all for a great deal but want it to be fairly painless, here are a few of our tried and tested cashback and loyalty rewards that will rack up the pounds without adding too much faff to your day. Taking five minutes to sign up to these cashback and loyalty schemes can help make your shopping pay back.

Shop for essentials and get money off your phone bill

Bits from Boots? Greggs sausage roll for lunch? It all adds up when you sign up to Airtime Rewards and start getting cashback on daily shopping - which comes directly off your monthly phone bill.

If you’re on O2, giffgaff, 3, EE or Vodaphone, this one’s a no-brainer. Download the app and sign up, then once you’ve registered your debit card you’ll start building up cashback automatically every time you shop in certain places (and there are loads of good shops and restaurants signed up).

Cashback amounts vary by retailer and will take about a month to come through (this is based on how long you have to return items etc) but once cashback is confirmed and you hit £10, you can redeem it directly from your phone bill with one click. From experience, we’ve seen it build up to a tenner every couple of months or so, based on everyday shopping.

Download the direct from app store / Google Play to browse all the shops & restaurants available and get started. What’s more, when you’re shopping at places like Boots or Tesco, you’ll still get your regular points and benefits on top.

The long-standing loyalty schemes we’re still here for

As supermarket loyalty cards go, some are slightly better than others, but all are rewarding if you’re doing the bulk of your shopping in one place, so signing up wherever you do your regular shop will definitely benefit.

The main differences I’ve found in using the loyalty schemes at local stores are in how instant the rewards feel. If I’m grabbing a couple of essentials in Co-op, it feels like everyday savings - I notice the cheaper member prices and usually have a few pence on my loyalty card which I can take off instantly at checkout. Sainsbury’s Nectar points feel more like a long game and I tend to save them up to spend elsewhere (e.g. Argos or Habitat). And who doesn't want to get the lower Tesco clubcard prices when you see them in-store?

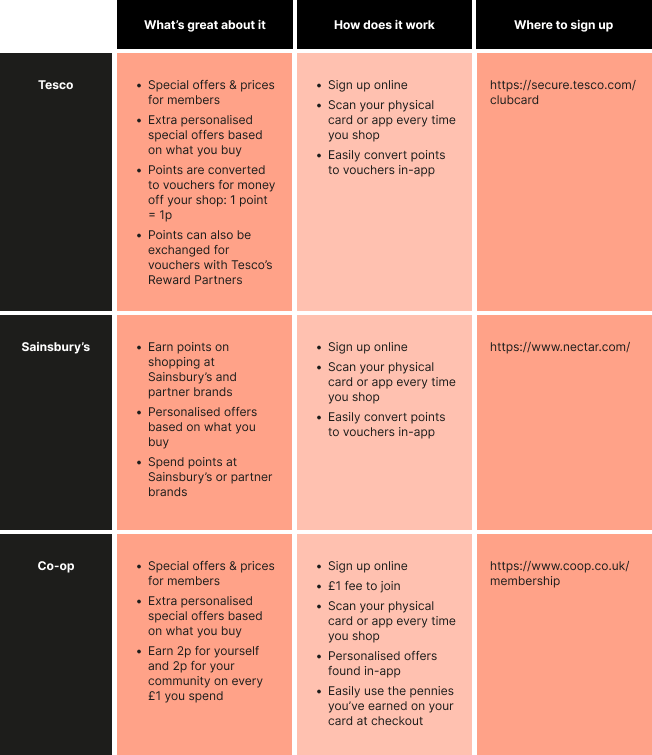

Most supermarket schemes are free to join (Co-op has a £1 joining fee) - if you’re interested in which shop offers the best benefits here’s a quick comparison table of a few of the top supermarket cards:

Elsewhere, the Boots advantage card has really proven itself over the years; it’s low fuss but high reward and we love to see it. These days you can still get yourself a plastic membership card, or make it super easy and just use the app to collect points when you shop. You rack up 3 points for every £1 you spend and get 10% off on Boots own brand ranges.

Enough about Boots cards but you get the point, it’s probably worth signing up to whatever loyalty scheme your local supermarket / chemist has going, even if it’s only pence, if it’s easy and it adds up then why not take advantage.

One final thing to stress – definitely bring your own bags when shopping, we all know it’s best for the planet, but it’s also a massive money saver in itself, so make sure it’s a habit because all the rewards you rack up will seem a bit pointless if you then have to pay for bags!

Save on the big stuff

Another quick win with no sting - adding PayPal Honey to your internet browser. It’s a free extension on Chrome that automatically finds coupons and rewards for over 30,000 sites. You can also sign up to Honey Gold, which means you earn rewards on some purchases too, which can be redeemed as gift cards.

The real plus on this has to be the fact it offers rewards on travel and flights, so if you’re making big purchases you know you’ll benefit from cashback, even if there are no current coupon deals - think SkyScanner, Premier Inn and Virgin Holidays to name a few.

Having tried it out, it’s a pretty good way to check if you can get any deals or money off at checkout and isn’t super time consuming.

Buy now, pay later - is it worth it?

Big deal, or big debt? This is your friendly reminder that some deals aren’t all they seem - there’s been a huge hype around buy now pay later over the last few years, but it feels a little bit like credit in disguise and we’re not sure we’re fully there for it.

Like any credit card or loan, when you’re borrowing money to make purchases, you’re probably going to get stung on interest payments down the line. We all take on debt throughout life for different reasons, but if it becomes unmanageable it can be bad for our wallets and mental health - leaving us out of pocket in more ways than one.

Keep on top so you don’t sweat the small stuff

Maybe we’re getting a bit too philosophical, but when life is about balance, we all need some joy amongst the hard work. If you’ve taken steps to get in control of your money and have some to spare after saving and covering the essentials, then you have the power to make informed decisions, without compromising on your longer term goals.

No, we haven’t forgotten we’re all exhausted by Friday night and just want dinner delivered directly to the door, but if you’re frequently ordering take out then even just subbing out a couple per month for supermarket fakeaways could save you a fair amount. Let’s look at some alternatives that cut the cost but not your sanity.

If you like a Domino’s or a takeout at the weekend, you could save yourself a bunch by grabbing a Sainsbury’s Dinner Deal, Tesco Finest Dinner for Two or an M&S Pizza Night Dine In on your way home. Even better, add them to your weekly shop so you’re all sorted for the weekend.

Just from some quick maths, a small Domino’s pizza will set you back £8 before sides, drinks and delivery costs; whilst you can get steak, chips, dessert & beer for two at just £12 in Sainsbury’s - which is a pretty sweet deal.

Reusable for everyday wins

This is your friendly reminder that it really does pay to go reusable these days.

Making a habit of taking your shopping bag and reusable coffee cup when you head out can be a quick win for small savings that will add up.

The facts:

Supermarkets charge between 10-60p per bag,

You can save between 25-50p on your coffee by using your reusable cup in places like Greggs, Pret & Starbucks

This information is intended for editorial purposes only and not intended as a recommendation or financial advice