Everyone wants to save money on car insurance

In this post, we’ll explain 6 cost saving hacks, exactly how much money it could save you, and give it a OnestopSave rating out of five stars which takes into account:

- How much money you could save

- How easy it is to implement

- Any hidden drawbacks it could have.

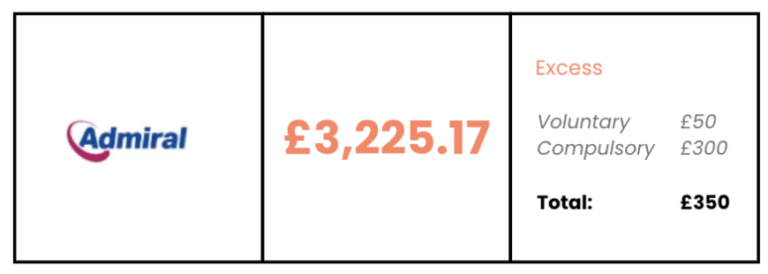

Let’s get into it. The following quotes are based on a new, 18-year-old driver living in the North West and willing to pay £50 voluntary excess on the insurance.

The vehicle? A 2017 Ford Fiesta with a 1.25L engine covering 10,000 miles per year.

The best initial quote* was a staggering £3,225.17 for a standard insurance policy.

At 18-years-old that’s likely more than you’d earn in a few months work and entirely unaffordable without financial help.

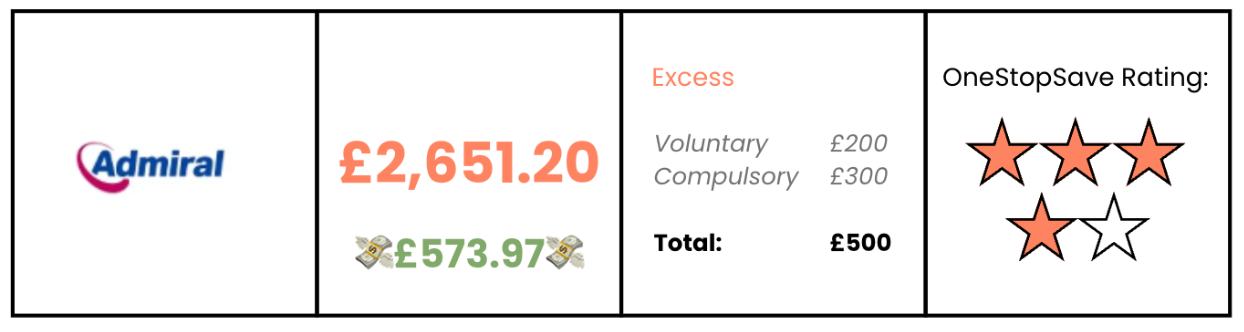

HACK #1 - Opting for a higher excess

One way of reducing your insurance premium is by offering to pay a higher excess on your policy, should you ever need to make a claim.

Saves: £573.97 ✅

”Only do this if you know you’d be able to afford to pay out the excess if you need to.

EmanFounder OnestopSave

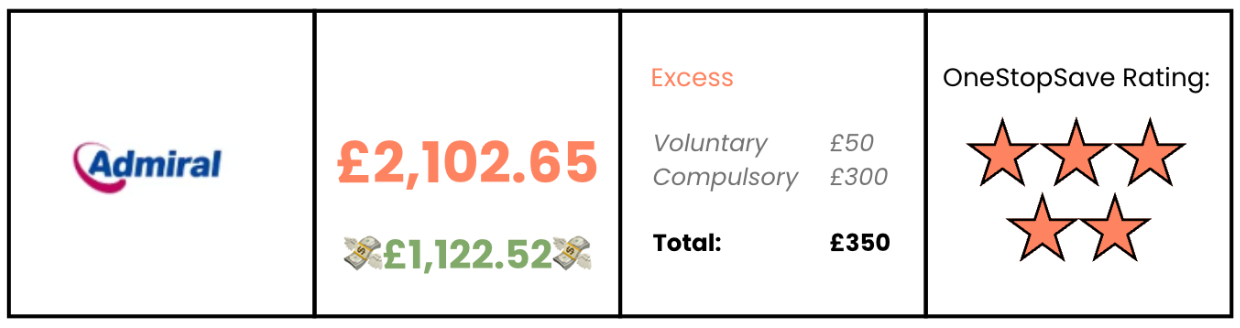

HACK #2 - Adding an additional driver

Adding a responsible, experienced person as a named driver on your policy can significantly reduce your premium. This is because the insurance company assumes there will be a little less time that you’ll be the sole driver of the car.

Saves: £1,122.52 ✅

”Make sure the person you name has a clean license and plenty of experience.

EmanFounder OnestopSave

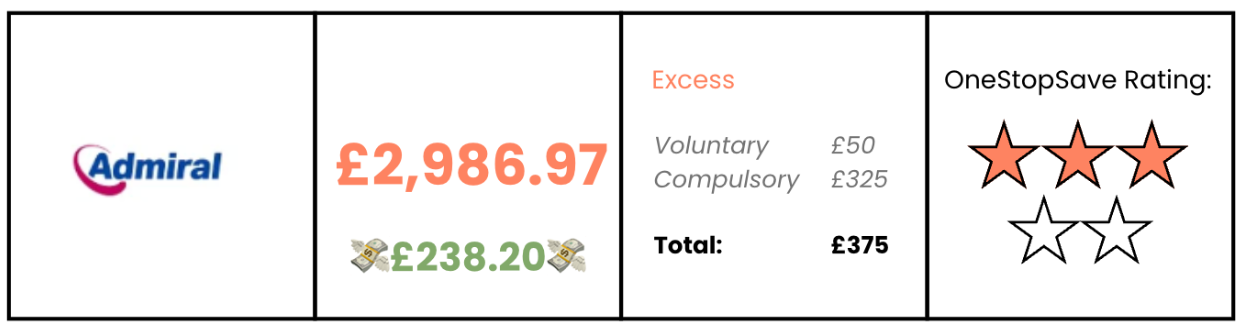

HACK #3 - Getting a lower insurance group vehicle

Purposely choosing a vehicle in insurance group 1, 2 or 3 could come with significant cost savings. For the following quote, we changed the vehicle to a 2017 reg Volkswagen Polo with only a 1.0L engine.

Saves: £238.20 ✅

”Always check the insurance group before you buy the car!

EmanFounder OnestopSave

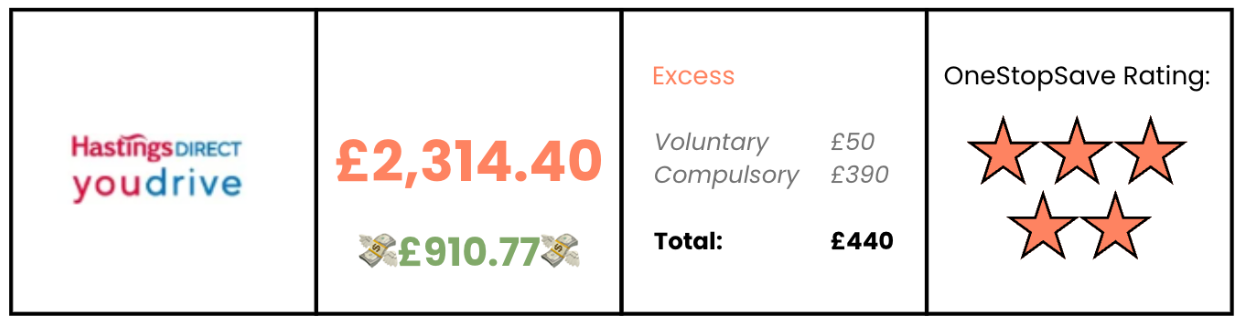

HACK #4 - Taking out a telematics policy

Getting a black box to monitor your driving as part of your policy can give the insurance provider the reassurance needed to knock hundreds off your policy.

If you’re considering a black box, check out our handy article on how New drivers could save with black box insurance

Saves: £910.77 ✅

”Most providers don’t impose any curfews - some even give money back if you're a good driver.

EmanFounder OnestopSave

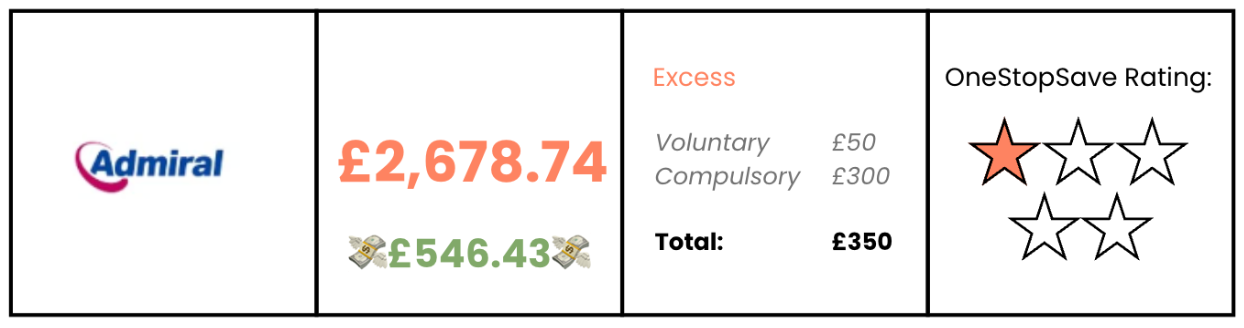

HACK #5 - Just get third-party cover

An insurance policy that only provides third-party cover means that you’ll be covered for damage to other people’s vehicles and property and any of their injuries. You won’t be covered for damage to your own vehicle or injuries. This is the minimum standard of cover legally allowed in the UK.

Saves: £546.43 ✅

”This one could cost you in the long run as you won't be able to claim if you’re involved in an accident.

EmanFounder OnestopSave

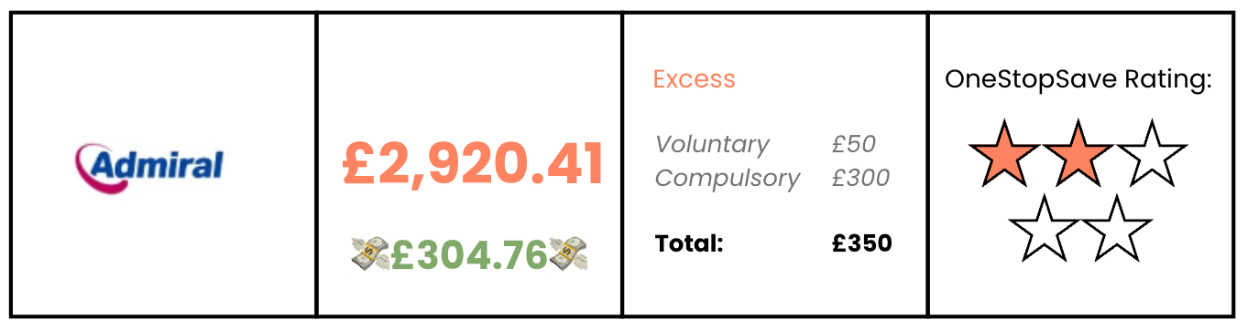

HACK #6 - Complete an advanced driving course

Ever heard of an advanced driving course? It’s where you demonstrate your competence as an even safer and more competent driver. These courses cost around £70 to £150 to complete.

Saves: £304.76 ✅

”This one doesn't quite pay off as the price of the course eats up most of your cost saving

EmanFounder OnestopSave

See if you can save money on car insurance

Hopefully one of our six hacks can help you save money when you compare car insurance.

The initial quote we ran with no hacks was a staggering £3,225.17, so if you’ve been quoted thousands of pounds like this, then don’t lose faith – there are plenty of options to help knock the premium down in a way that’s legal, without imposing on the benefits you’re going to get from owning a car.

This information is intended for editorial purposes only and not intended as a recommendation or financial advice

[*All quotes are correct as of October 2024]